Find out more ->

Sales Tax Solved.

Put your sales tax on autopilot in 3 minutes

No long-term contract. No credit card required.

Monitor

1

Collect

2

File

3

Trusted by leading businesses worldwide

9h+

Customers save per month

98.6%

Reduction in errors

84%

Registration time reduced

99.8%

Fees and penalties reduced

$500M

Transactions processed

12M+

Transactions evaluated

5000+

Filings completed

600+

Registrations done

Kintsugi: A fully automated sales tax solution

Free exposure monitoring

Worry free real-time nexus tracking and alerts.

State registration

Automatic registration in every jurisdiction.

Remittance

Remit everywhere with the click of a button.

Sales tax exemptions

Apply for sales tax exemptions certificates with one click.

Sales tax filing

File accurately and on time everywhere you need to.

Voluntary disclosure agreement

A VDA cuts penalties for businesses revealing past tax errors promptly.

Sales tax lifecycle

We manage and track this lifecycle to keep you compliant.

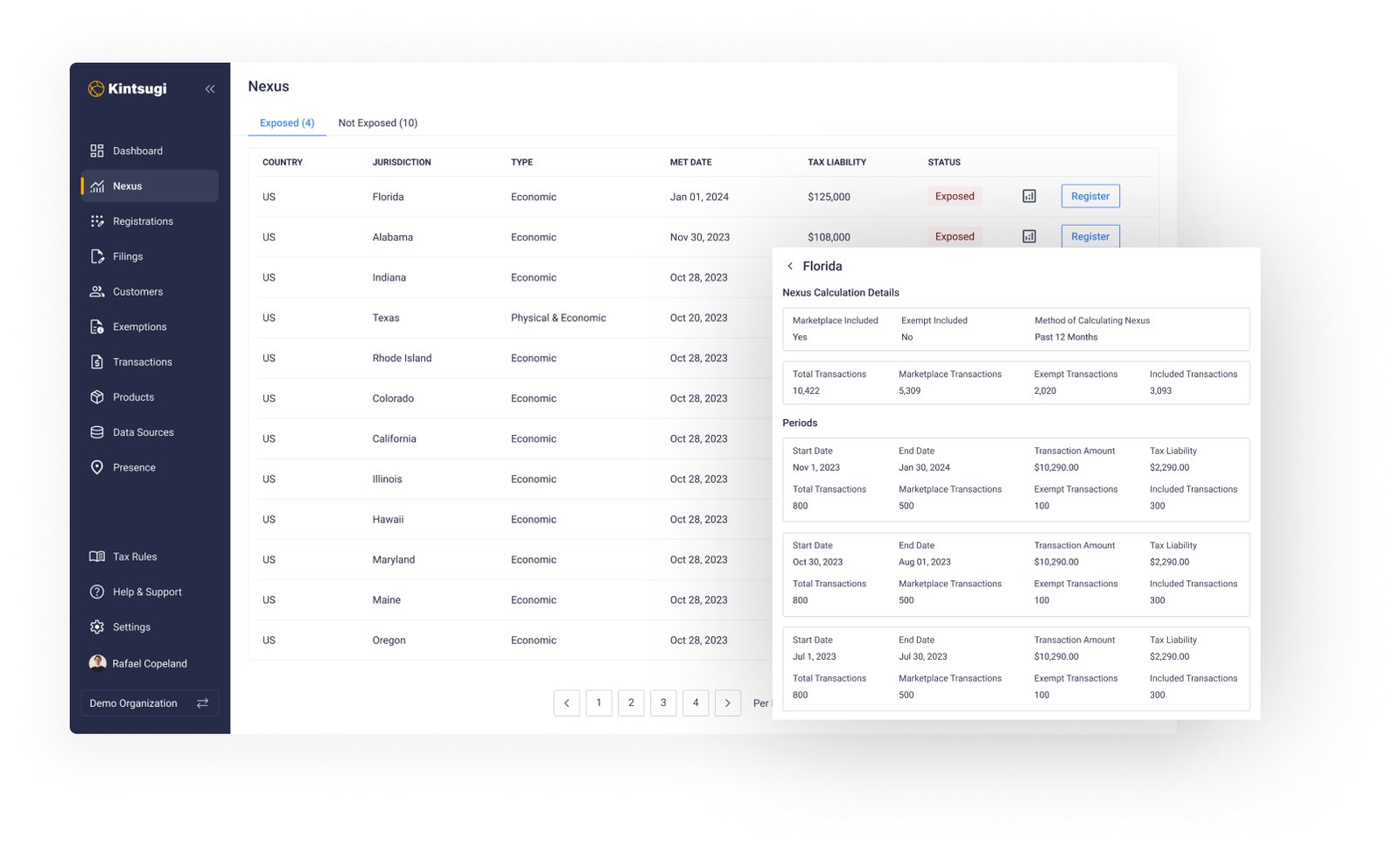

See nexus and register

Identify where your business must register and and pay sales tax by evaluating physical and economic nexus for each jurisdiction.

Collect taxes

Register where you have established nexus and determine how frequently you must file and remit sales tax.

File and remit

Accurately collect taxes for all jurisdictions at the point of sale (POS) based on address and product type.

Kintsugi serves top FinTechs and industry leaders

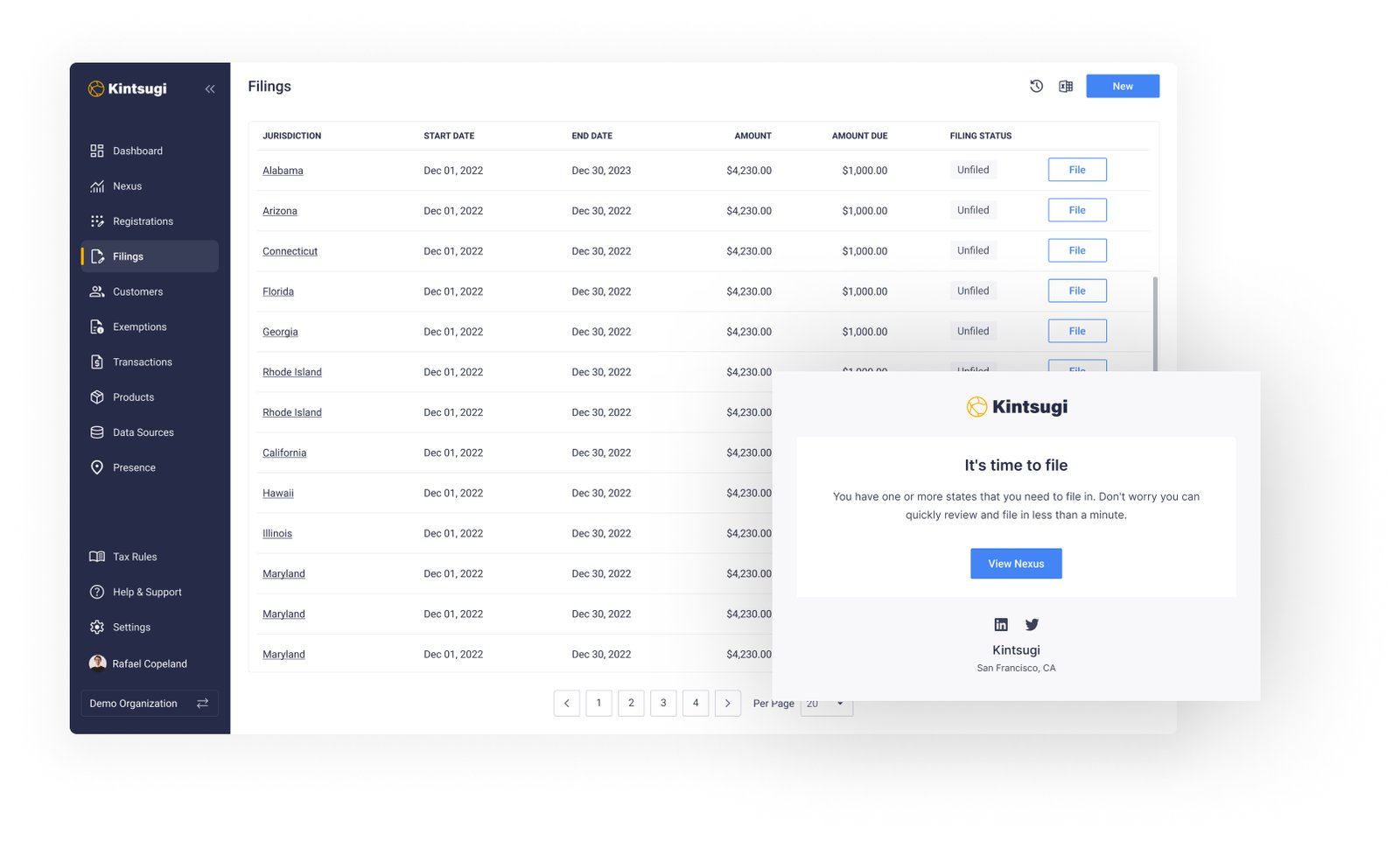

Never miss a filing again

Automate manual tasks with a single click. Standardize your data and review it before filing. File across states easily, avoid errors, and get reminders and predictions so you never miss a deadline again.

Learn more

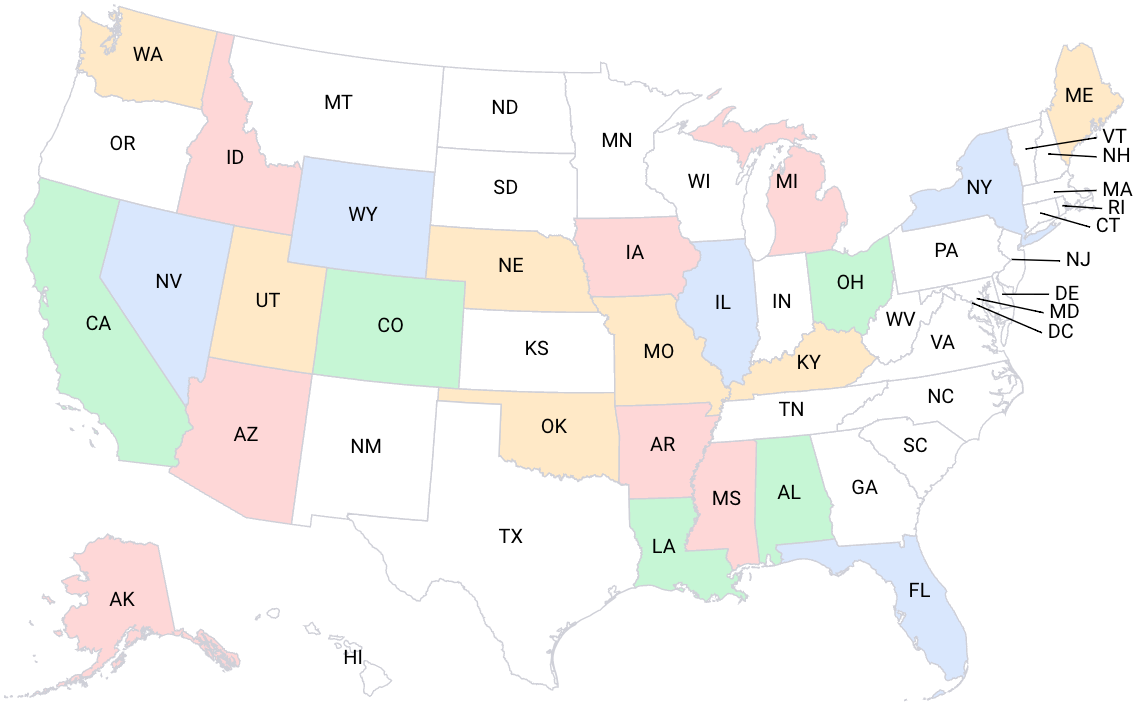

Know where and when to pay

Gain valuable insights into your nexus, including both physical and economic presence, at no cost. Our platform allows you to easily identify your nexus locations and monitor economic thresholds.

Learn more

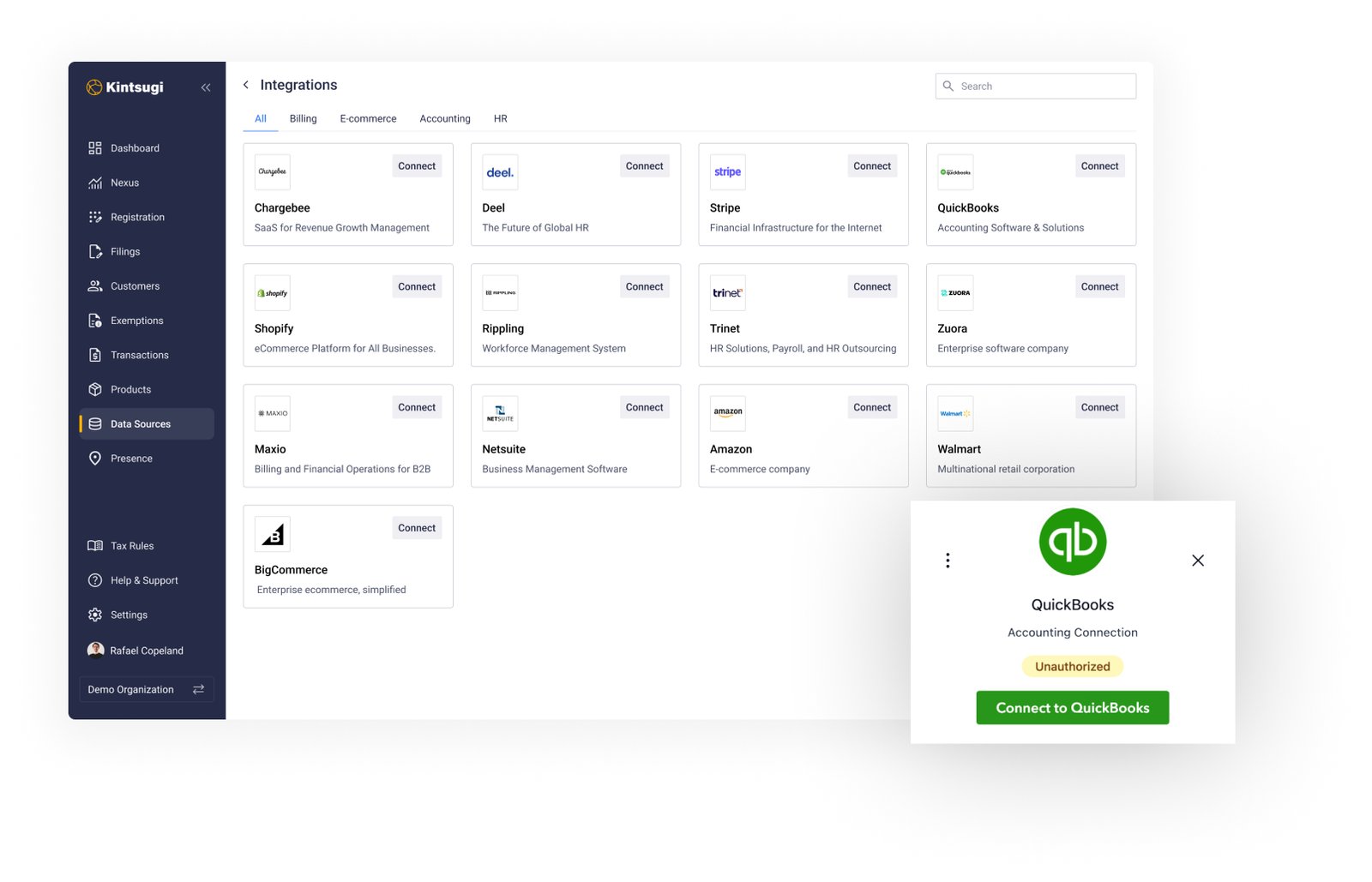

Integrate across your stack

We integrate with Stripe, Chargebee, Shopify, or any other e-commerce, SaaS, and ERP platforms so you can sell across channels and keep everything in one place.

Learn more

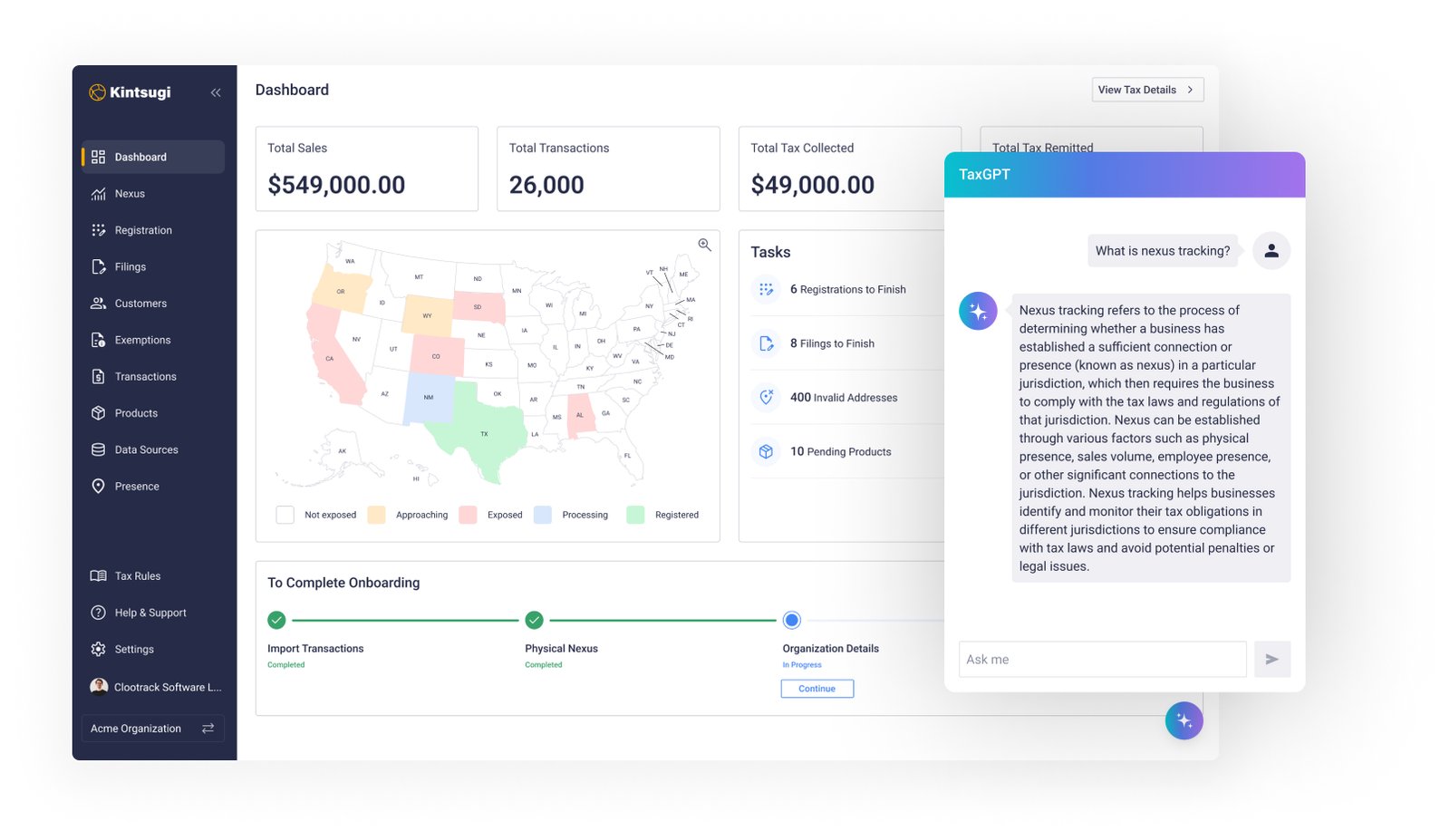

TaxGPT: your AI tax assistant

Get instant, secure support and accurate insights on your business's unique sales tax issues. No need to dig through confusing state websites! TaxGPT is trained to know your business inside and out.

Learn more